Table of Contents

Everyone loves gifts. It’s not just about the happy feeling of receiving something but the gesture that shows how much a person loves and respects you and wants you to say in their lives. The occasions for gifting (birthday, marriage, etc.) are few and a gift should be meaningful and useful. But there’s no dearth of gifts in the market.

While we all present the occasional knick-knacks, we seldom give financial and health security. No one is immune to medical emergencies, and they drain health and savings equally. Therefore, one of the best gifts you can give your family members or friends is a good health insurance policy. Browse through the options on Policybazaar before choosing the right one for your loved one.

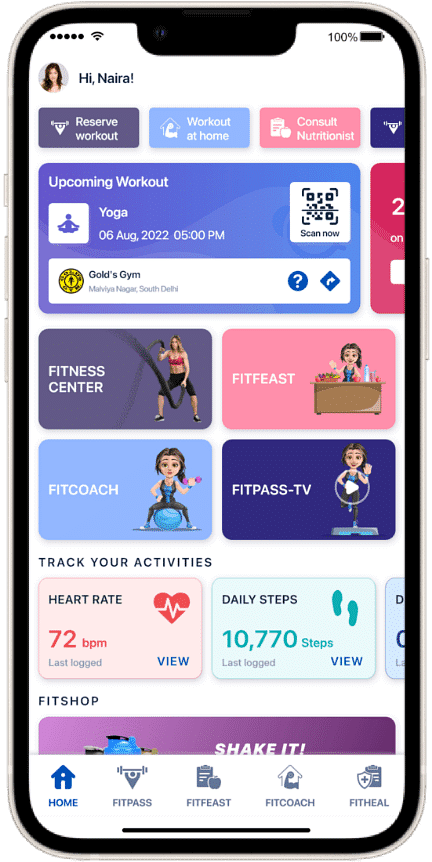

FITPASS + Health Insurance Plan - FITPASS Suraksha offers the best of both worlds. You get 3-month FITCOACH (AI-led fitness coach for customized workouts) and FITFEAST (Personal nutritionist and a bunch of in-app services) memberships along with Mediclaim benefits of up to ₹50,000. The health insurance benefits include cover benefits for hospitalization due to coronavirus.

Consider the Rising Medical Costs

The Indian healthcare sector has been evolving leaps and bounds. Even the most chronic ailments are treatable, which has improved life expectancy in our developing country. In fact, India attracts a lot of medical tourism in cities such as Delhi, Chennai, and Mumbai from several countries across the world where medical services are unaffordable for many.

The developments however come at a considerable cost and thus medical services are expensive for a majority of the Indian families. The private medical institutes and hospitals have a high rate of healthcare. Therefore, you should buy health insurance for financial security as well as good health. Those who do not have a good Mediclaim policy often spend their hard-earned savings. A good health insurance policy reduces the financial burden on your pocket. Moreover, a good Mediclaim policy offers financial and health safety in these unprecedented times.

Why You Should Gift Health Insurance

Having a good health cover means you are covered for medical emergencies, which is one of the most important aspects of financial planning. Gifting health insurance promotes financial freedom and fosters sound financial decisions in the future. For example, if your child is turning 18 years old, health insurance is an ideal gift that will ensure good health in the future and will be one less thing to worry about for him or her.

When we gift something, we think (or should think) about its value. While it’s okay to buy electronics that everyone cherishes, nothing exceeds in value than a good health insurance policy. If your loved one ever gets hospitalized, he or she won’t have finances to worry about while recovering. You can choose from a variety of health insurance policies on aggregators like Policybazaar. Go through the inclusions and exclusions carefully before buying one.

The idea is to have a health cover that ensures that your loved one gets the medical attention he or she requires when the time comes. Find out if the health insurance policy you’re gifting includes periodic health check-ups along with other benefits.

Most health insurance plans include cashless treatment, which saves a lot of time and effort. The insurance company pays off the amount to the hospital directly without you having to pay it out of your pocket and then wait for the reimbursements. Check the list of hospitals in association with the health insurance company before getting it.

Health insurance policies protect you against medical emergencies and also offer benefits that help you save your hard-earned money. You can avail tax benefits for paying premium under the Income Tax Act, 1961. These dual benefits make buying health insurance not only necessary but desirable as well.

How to Choose the Right Health Cover

You will come across a plethora of options when you browse the policies on Policybazaar or any other website. Making a good decision is important because Mediclaim policies cannot be easily changed. Plus, when gifting, you have to be sure that it suits the needs of your loved one. Check out the Mosquito Insurance and Hospitalization Cash Policies by Religare and HDFC Ergo offered together with fitness memberships in the FITPASS + Health Insurance Plan.