Table of Contents

Investment is one of the most important acts in the modern world, no matter which aspect of life it covers. We all need security and research-backed investment always takes care of that. While the stock market and real estate seem like the obvious choices, investing in health is equally important, if no more. After all, healthy life is the biggest luxury you can afford.

Essentially, you can invest in your health through fitness memberships and health insurance policies - bought through agents or online from PolicyBazaar and other health insurance policy aggregators. We’re discussing why and how investing in the best health insurance and fitness memberships together is the best and the cheapest option.

Exercise & Healthy Eating Prevent Illnesses

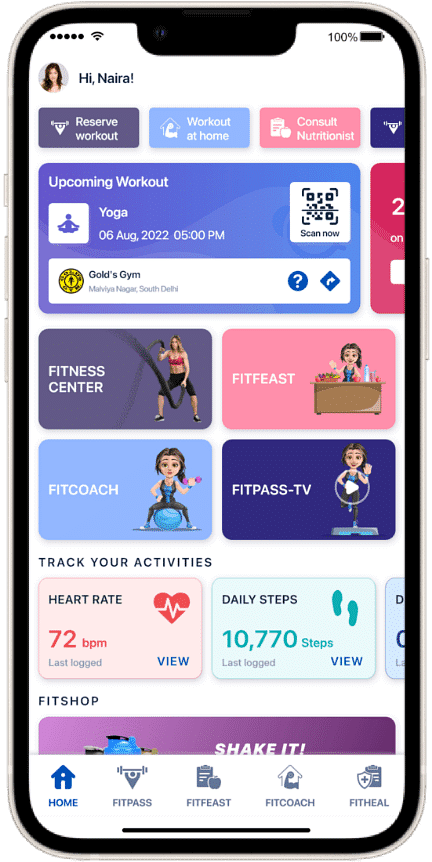

Numerous studies done over the years point toward a universal truth – staying active is synonymous with good health. Working out regularly reduces the risk of disease in addition to strengthening the immune system. Strong immunity is your biggest shield against the most deadly diseases and illnesses. Therefore, investing in memberships like FITCOACH – AI-led fitness coach that provides dynamic workout videos in HD for home workouts and FITFEAST - your personal nutritionist for daily diet suggestions, help prevent health issues and save money on medicines, hospitalization, ambulance charges, lab tests, etc.

Buy Health Insurance to Cover Medical Expenses

Some medical emergencies are unavoidable and the associated treatment costs are considerable. It makes much more financial sense to pay a small health insurance premium rather than dipping into your savings when illnesses affect you and your family. A good Mediclaim policy covers a majority of medical expenses including hospitalization, operation theatre charges, etc.

The FITPASS +Health Insurance Plan - FITPASS Suraksha offers health benefits of up to ₹50,000 through HDFC Ergo health insurance and Religare health insurance along with assured savings of at least ₹5,000 on e-pharmacy, lab tests, e-consults on 1mg. Additionally, you can avail a flat 30% discount on ayurvedic products by Dr. Vaidya’s Ayurveda. All of this at a one-time cost starting at just ₹249*.

Good Diet is a Long Term Investment

“You are what you eat”. And if your daily diet focuses on nutrition i.e. if you eat healthy, you stay healthy. A balanced combination of carbs, fats, and proteins maintain bodily functions and thus, reduce the effect of pathogens. The benefits of healthy eating are rather like the returns on long-term investments on mutual funds, real estate, etc. Consider this - avoiding consumption of unhealthy foods often allows the body leeway to fight other foreign pathogens that cause unwanted illnesses. The long-term investment analogy is logical since several underlying conditions, often caused due to unhealthy eating habits, such as high cholesterol, high blood pressure, and other heart problems can easily contribute to other illnesses and make recovery much harder.

Cashless Claim Benefits

Earlier, availing the benefits of health insurance policies meant filling out lengthy paperwork and waiting for reimbursements. With the cashless transaction benefits, the hospital or health service provider is paid directly by medical insurance companies like HDFC Ergo and Religare among others. You are exempted from having to pay bills out of your pockets, leaving you short of dispensable savings, with the cashless claim benefit.