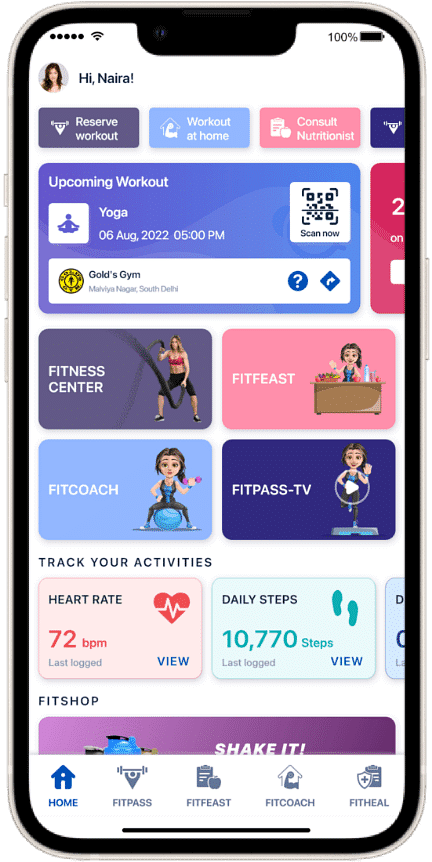

You. And your family and friends. The FITPASS memberships and Health Insurance Policy combos have been curated to serve the health and fitness needs of all adults.

Sedentary lifestyles have made it indispensable to eat well and exercise regularly. And the pandemic is a great example of how unforeseen events can expose us to deadly diseases. Therefore, everyone needs fitness memberships and the best health insurance policies.

Our FITPASS + Health Insurance Policy Plan is based on a one-time premium that offers benefits to people between the ages of 18-65*. The combo plans start at just ₹249 and offer benefits amounting up to ₹50,000 and assured savings of at least ₹5,000.

Young Adults

Investing in health insurance and fitness memberships at an early age is lauded by many health experts. As trends suggest, young adults are usually keen on hitting the gym or sports complexes but leave health insurance to their family or just do not consider it important. In fact, both are essential.

If you’re a young adult, note that you can get the best health insurance policies at the lowest premiums at a young age. The FITPASS + Health Insurance policy - FITPASS Suraksha covers most major medical expenses like hospitalization charges, lab tests, medicines, etc. Moreover, it includes 3-month FITCOACH & FITFEAST memberships for home workout suggestions and proper nutritional assistance.

Middle-aged Adults

The body functions slow down a little once a person reaches his 40s. However, if you consider athletes and professional sportspersons, they hardly fall ill and continue to play professionally until the ages of 35-40. That is because they workout every day and eat healthy foods.

Sedentary lifestyles and unhealthy eating habits lead to health problems that can be avoided. As far as unavoidable health conditions such as mosquito-bred diseases are concerned, a good Mediclaim policy makes it easy to manage finances during a medical emergency, helps with tax savings, and basically secures your future.

Benefits offered by the HDFC Ergo Health Insurance and Religare Health Insurance along with 1mg and Dr. Vaidya’s Ayurveda under the FITPASS + Health Insurance Plan - FITPASS Suraksha makes life healthier and easier for you. Medical emergencies can occur at any time in your life. Improve your health and secure your future with the FITPASS + Health Insurance plan.