Table Of Contents

- Key Takeaways

- The Fitness Taxation Dilemma

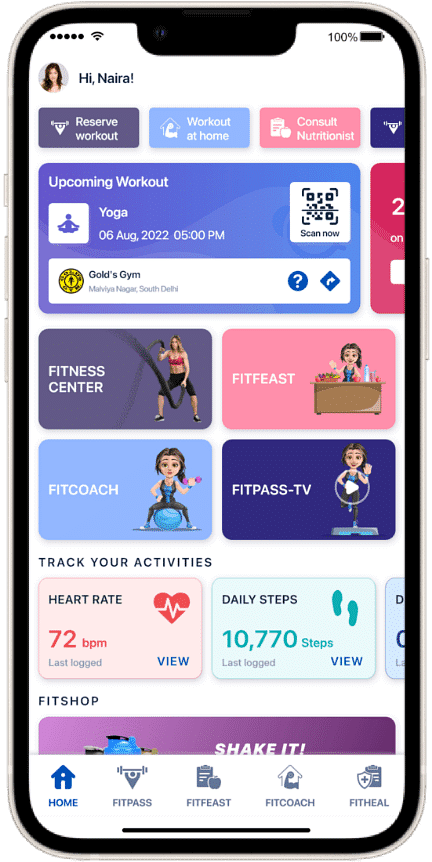

- FITPASS and the Journey of Change

- The Preventive Health Paradox

- Fitness Taxation Vs Healthcare Subsidies

- Why Fitness Should Be Tax-Free

- Aligning Policy with National Health Goals

- Conclusion

India’s fitness industry has grown tremendously in the last decade, fuelled by rising awareness of lifestyle diseases and the government’s own push through campaigns like the Fit India Movement, Khelo India, Eat Right India, and Anti-Obesity Mission. Yet, when it comes to taxation, a paradox persists: staying fit costs more than falling sick.

This is because fitness services like gym memberships, yoga classes, and wellness coaching attract a hefty 18% GST, while most medical treatments and healthcare services are either exempt or taxed minimally. The result? Preventive health becomes more expensive than curative care.

At the heart of challenging this imbalance is FITPASS, which has consistently advocated for a fairer tax structure on fitness. From successfully pushing GST on fitness membership down from 28% to 18%, to driving the IRDAI policy change, FITPASS has been a strong voice for India’s health-first future. And now, the third push is underway: fighting for GST exemption or a maximum 5% slab on fitness memberships.

Key Takeaways

- Preventive vs Curative Paradox: Healthcare services are exempt from GST, but fitness services attract 18%.

- FITPASS Advocacy: Played a key role in reducing GST on fitness from 28% to 18%, and in influencing the IRDAI’s wellness coverage reforms.

- The Third Push: FITPASS is now aiming for either exemption or a 5% GST cap on gym memberships and wellness services.

- Long-term Benefits: Lower taxes on fitness would encourage preventive health, reduce healthcare costs, and align with national health goals.

The Fitness Taxation Dilemma

Fitness in India continues to be treated as a luxury, not a necessity. Services like gyms, aerobics, Zumba, and yoga (unless under charitable trusts) all attract 18% GST.

- Example: A ₹2,000 gym membership becomes ₹2,360 after GST. Over 12 months, the additional burden is more than ₹4,000 – just as tax.

- In contrast, medical services such as hospitalisation, consultations, and diagnostic tests are largely exempt. Essential medicines attract only 5–12% GST, and many are subsidised.

This creates a distorted reality where falling sick is cheaper than staying fit.

FITPASS and the Journey of Change

FITPASS has been more than just a fitness subscription provider; it has been an advocate for systemic change. Over the years, FITPASS has actively engaged with policymakers to ensure fitness is recognised as preventive healthcare rather than a luxury.

1. From 28% to 18% GST: A Landmark Shift in 2018

When GST was first implemented, fitness memberships were placed under the 28% slab, the same as luxury items like cinema tickets and high-end hotels. FITPASS challenged this unfair classification, pushing for recognition of fitness as a health essential.

In 2017, our Co-founder, Akshay Verma, was invited by the Ministry of Finance to participate in the pre-budget consultations with the Hon’ble Finance Minister, alongside other industry leaders. The discussions focused on how taxation for the sector should be reduced, marking the beginning of a wider dialogue on recognising fitness as a health essential rather than a luxury. Through consistent representation, advocacy, and engagement with policymakers, FITPASS played a pivotal role in influencing the GST Council’s decision to reduce GST on fitness services from 28% to 18%. This landmark move was the first major step in making fitness more accessible to millions of Indians.

2. The IRDAI Policy Change in 2020: Recognising Wellness

FITPASS was also instrumental in advocating for insurance reforms. Earlier, most health insurance policies only covered treatment, not prevention. FITPASS worked with stakeholders and supported the Insurance Regulatory and Development Authority of India (IRDAI) in making a policy change that recognised wellness and fitness under insurance benefits.

A three-year pilot was conducted to study the impact of such reforms, and on 4th September 2020, FITPASS received the official notification about the change. This shift acknowledged that prevention is as important as cure and opened up avenues for fitness costs to be factored into insurance plans.

3. The Third Push in 2025: Towards Exemption of GST Slab

Now, FITPASS is leading its third major effort, seeking a complete GST exemption on fitness memberships.

The argument is simple: fitness should not be taxed like a luxury when it prevents diseases that cost billions in healthcare spending. Exempting GST would encourage more people to invest in their health, reduce the nation’s long-term healthcare burden, and align with the government’s Fit India mission.

The Brutal Numbers

- 101 million Indians have diabetes.

- 315 million live with hypertension.

- 63% of deaths are caused by preventable diseases.

By 2060, obesity alone will cost India ₹69.6 lakh crore, that’s 2.5% of our entire GDP.

Yet, more than half of Indians don’t exercise enough. By taxing fitness, we are pricing people out of prevention.

You can help change this. Click here to sign the petition and join us in making fitness accessible for all.

The Preventive Health Paradox

According to the World Health Organisation (WHO), every ₹1 invested in prevention saves ₹3 in curative treatment. Yet, India’s taxation structure discourages preventive health by making it costlier than the cure.

A 2022 Lancet study highlighted that India loses nearly 6% of its GDP annually to lifestyle diseases such as diabetes, hypertension, and cardiovascular issues. Encouraging fitness through affordable access is the most sustainable way to tackle this.

FITPASS’ advocacy directly addresses this paradox: by lowering taxes on fitness, the government can indirectly reduce future healthcare expenses.

Fitness Taxation Vs Healthcare Subsidies

Let’s compare:

- Healthcare: Exempt from GST, subsidised medicines, government insurance schemes.

- Fitness: Attracts 18% GST, no subsidies, no direct tax benefits.

This imbalance explains why, despite rising health awareness, gym penetration in India is still under 5% of the population.

Why Fitness Should Be Tax-Free

FITPASS’ advocacy is rooted in strong logic:

- Healthier citizens, lower costs – Preventive health reduces government and personal spending on treatment.

- Greater accessibility – Exempting or reducing GST would bring fitness within reach of more people, especially the middle class.

- Policy alignment – Supports Fit India Movement, NITI Aayog’s preventive health goals, Khelo India, Eat Right India, and Anti-Obesity Mission.

- Economic productivity – A healthier workforce contributes more to the economy.

Aligning Policy with National Health Goals

The government spends thousands of crores every year to treat lifestyle diseases, but spends much less on prevention. Taxing fitness at 18% contradicts its own national health policies.

By supporting FITPASS’ advocacy, the government can:

- Encourage preventive health.

- Reduce long-term healthcare costs.

- Build a stronger, healthier India.

This is not just about taxation, it’s about rethinking the cost of prevention vs cure in India.

Conclusion

The GST paradox highlights how India’s taxation structure discourages fitness while supporting treatment. FITPASS has already made a difference, first by reducing GST from 28% to 18%, in 2018 then by supporting the IRDAI policy change that recognised wellness in insurance in 2020.

Now, the third push is underway: fighting for GST exemption on fitness memberships. This step would align India’s tax policies with its health goals, reduce the national burden of lifestyle diseases, and make fitness accessible to millions.

It’s time to move from penalising prevention to promoting wellness.

What is the current GST rate on gym memberships in India?

The current GST rate is 18% on gym memberships, personal training, and wellness services.

What role has FITPASS played in GST reforms?

FITPASS was instrumental in reducing GST on fitness from 28% to 18%, and later supported the IRDAI’s policy change that included wellness in health coverage.

What is FITPASS’ current demand regarding GST on fitness?

FITPASS is advocating for either a complete exemption or a maximum 5% GST slab on fitness services to make preventive health more affordable.

Why should fitness be exempt from GST?

Because fitness is preventive healthcare, not a luxury. Lowering or removing GST would encourage more participation, reduce lifestyle diseases, and lower healthcare costs in the long run.